Report: Uneven and Incomplete Recovery for Cook County Property Values

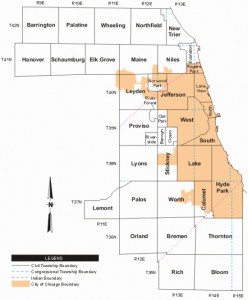

While property values in Cook County rose in 2015 and 2016, neither commercial nor residential values on average countywide have recovered to 2009 levels, data from the Cook County Assessor’s Office shows.

While property values in Cook County rose in 2015 and 2016, neither commercial nor residential values on average countywide have recovered to 2009 levels, data from the Cook County Assessor’s Office shows.

Residential property values have been particularly slow to recover, with growth of 5% in 2015 and 4% in 2016 leaving those assessed values still 14% short of 2009 levels.

Continue reading

There are many reasons homeowners in Cook County don’t appeal their property tax assessments.

There are many reasons homeowners in Cook County don’t appeal their property tax assessments.

When you see or hear the words “Cook County property taxes” in the headlines, you can pretty much assume it’s not going to be good news. Unless, perhaps, you are a well-heeled business owner with a team of attorneys scrutinizing your tax bills.

When you see or hear the words “Cook County property taxes” in the headlines, you can pretty much assume it’s not going to be good news. Unless, perhaps, you are a well-heeled business owner with a team of attorneys scrutinizing your tax bills.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees