Partial Property Tax Deferral Available for Some Harris County Residents

If you live in Harris County Texas and you’re worried that you won’t be able to pay the total amount due on your property taxes, a deferral is an option to postpone paying part of them.

It’s a deferral of taxes on increases in the value of your primary residence and it allows you to postpone paying taxes on a portion of the appreciating value of your home. You must file a tax deferral affidavit to take advantage of this option, which can be done for free at the Harris County Appraisal District’s (HCAD) office.

How Does It Work?

According to HCAD, this residence homeowner tax deferral allows eligible homeowners to pay property taxes on 105% of the preceding year’s appraised value of their home, plus the taxes on new improvements, and postpone paying the remainder for as long as they own and live in the house. The remainder of the taxes must be paid on time every year and interest on the deferred amount will accrue at 8% a year.

Continue reading

As with many things, doing your homework is the key to success in appealing your property tax assessment, especially in Chicago and throughout Cook County.

As with many things, doing your homework is the key to success in appealing your property tax assessment, especially in Chicago and throughout Cook County. The Cook County Assessor’s office has mailed 2018 assessment notices to Oak Park homeowners. Property owners have 30 days to appeal their assessment, through the Assessor’s office, up to the deadline of Monday, April 2nd.

The Cook County Assessor’s office has mailed 2018 assessment notices to Oak Park homeowners. Property owners have 30 days to appeal their assessment, through the Assessor’s office, up to the deadline of Monday, April 2nd. Eligible Cook County homeowners who did not receive the Homeowner Exemption in 2018 need to file an application for exemption with the Cook County Assessor’s Office by March 6.

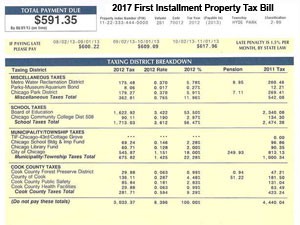

Eligible Cook County homeowners who did not receive the Homeowner Exemption in 2018 need to file an application for exemption with the Cook County Assessor’s Office by March 6. The least favorite piece of mail Cook County homeowners receive hit their mailboxes last month: the dreaded property tax bill.

The least favorite piece of mail Cook County homeowners receive hit their mailboxes last month: the dreaded property tax bill.

2018 assessment notices were mailed to Berwyn Township property owners today. The Cook County Assessor’s 30 day window for homeowners to appeal their assessment will be open until the closing date of Monday, April 2nd.

2018 assessment notices were mailed to Berwyn Township property owners today. The Cook County Assessor’s 30 day window for homeowners to appeal their assessment will be open until the closing date of Monday, April 2nd. 2020 Triennial reassessment notices were mailed to Oak Park Township homeowners on Thursday, February 27th. Homeowners in Oak Park Township have 40 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is April 7th.

2020 Triennial reassessment notices were mailed to Oak Park Township homeowners on Thursday, February 27th. Homeowners in Oak Park Township have 40 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is April 7th. Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees