Schaller’s Pump: A Cook County Property Tax Cautionary Tale

Up until April 29, 2017, Schaller’s Pump had been the oldest continuously run Chicago tavern, having survived Prohibition, the Great Depression, two world wars, and the Great Recession, until Cook County property taxes put it out of business.

Up until April 29, 2017, Schaller’s Pump had been the oldest continuously run Chicago tavern, having survived Prohibition, the Great Depression, two world wars, and the Great Recession, until Cook County property taxes put it out of business.

What can Schaller’s Pump teach homeowners about property taxes? Simply this: before you buy a home, be sure to understand its history of property taxes, exemptions and property tax appeals.

Continue reading

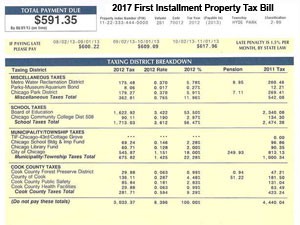

As we all await the dreaded second installment of our 2017 property tax bills, two concerns arise for what we’ll find in our mailbox:

As we all await the dreaded second installment of our 2017 property tax bills, two concerns arise for what we’ll find in our mailbox:

The conventional wisdom is to

The conventional wisdom is to

In a recent move described as “historic,” the Cook County Board of Commissioners have approved the “Cook County Taxation Predictability and Long-Term Fiscal Forecasting Amendment.” This has been described as freezing Cook County’s property and sales tax rates until January 1, 2020.

In a recent move described as “historic,” the Cook County Board of Commissioners have approved the “Cook County Taxation Predictability and Long-Term Fiscal Forecasting Amendment.” This has been described as freezing Cook County’s property and sales tax rates until January 1, 2020.

Most property tax reductions are achieved by successfully associating your home with

Most property tax reductions are achieved by successfully associating your home with  Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees