Board of Review Opens Group 5A for 2024 Property Tax Appeals!

Attention Cook County homeowners! The Board of Review has officially opened the window for property tax appeals for Group 5A 2024. If you reside in any of the following townships, now is the time to act:

Attention Cook County homeowners! The Board of Review has officially opened the window for property tax appeals for Group 5A 2024. If you reside in any of the following townships, now is the time to act:

- Leyden

- Lyons

- Northfield

- Orland

- Proviso

- Wheeling

Key Deadline Alert: You have until December 17, 2024, to submit your appeal.

If you missed your chance to appeal earlier in the year or weren’t satisfied with the outcome of your previous appeal at the Assessor’s office, don’t worry—there’s still a chance to make your voice heard. Property assessments can be challenged annually, so take advantage of this opportunity!

Why should you consider appealing? A successful appeal could potentially lower your 2024 assessed value and provide significant property tax relief for your 2025 second installment.

Continue reading

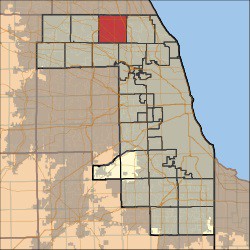

Attention Wheeling Township Homeowners: Important Property Assessment Update!

Attention Wheeling Township Homeowners: Important Property Assessment Update! 2023 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, August 31, 2023, to Wheeling Township property owners. The window to appeal your 2023 assessed value is now open until the deadline of October 02, 2023. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Mount Prospect, Northbrook, Prospect Heights (majority), and Wheeling (majority).

2023 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, August 31, 2023, to Wheeling Township property owners. The window to appeal your 2023 assessed value is now open until the deadline of October 02, 2023. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Mount Prospect, Northbrook, Prospect Heights (majority), and Wheeling (majority). The Cook County Board of Review has opened 2022 property tax appeals for the eighth group. The

The Cook County Board of Review has opened 2022 property tax appeals for the eighth group. The  The window to appeal your 2021 assessed value is now open until the deadline of November 05, 2021. 2021 property assessment notices were mailed to Wheeling Township property owners by the Cook County Assessor’s Office on Tuesday, October 05, 2021. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Mount Prospect, Northbrook, Prospect Heights (majority), and Wheeling (majority).

The window to appeal your 2021 assessed value is now open until the deadline of November 05, 2021. 2021 property assessment notices were mailed to Wheeling Township property owners by the Cook County Assessor’s Office on Tuesday, October 05, 2021. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Mount Prospect, Northbrook, Prospect Heights (majority), and Wheeling (majority). The Cook County Board of Review has opened 2020 property tax appeals for the sixth group of townships. The

The Cook County Board of Review has opened 2020 property tax appeals for the sixth group of townships. The  2020 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, May 14th 2020, to Wheeling Township property owners. The window to appeal your 2020 assessed value is now open until the deadline of June 19th.

2020 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, May 14th 2020, to Wheeling Township property owners. The window to appeal your 2020 assessed value is now open until the deadline of June 19th. The Cook County Board of Review has opened 2019 property tax appeals for the eighth group. The

The Cook County Board of Review has opened 2019 property tax appeals for the eighth group. The  2019 Triennial reassessment notices were mailed to Wheeling Township homeowners on Monday, July 8th. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Glenview, Mount Prospect, Northbrook, Palatine (east of 53), Prospect Heights (majority), Rolling Meadows, and Wheeling (majority). Homeowners in Wheeling Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is August 8th.

2019 Triennial reassessment notices were mailed to Wheeling Township homeowners on Monday, July 8th. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Glenview, Mount Prospect, Northbrook, Palatine (east of 53), Prospect Heights (majority), Rolling Meadows, and Wheeling (majority). Homeowners in Wheeling Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is August 8th. Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees