Cook County Property Taxes: Disabled Veteran Exemption Update

Veterans who own a home in Cook County that are disabled 70% or more no longer have to pay property taxes thanks to recent legislation (SB 107).

Veterans who own a home in Cook County that are disabled 70% or more no longer have to pay property taxes thanks to recent legislation (SB 107).

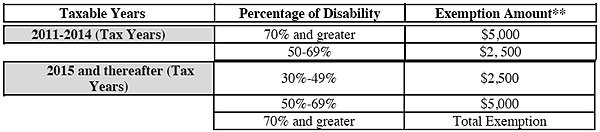

The Cook County Assessor has expanded the Disabled Veterans Homeowner Exemption to 100% from a limit of $5,000 previously (see table), for the tax year 2015, which is billed and due in 2016.

Additionally, veterans whose level of disability is between 30-70% are eligible for a property tax exemption of $2,500-$5,000 (see table). These exemptions only apply to veterans with a service-connected disability as certified by the U.S. Department of Veterans Affairs, and whose primary residence is in Cook County. Non-remarried surviving spouses are also eligible.

Cook County Disabled Veteran Homeowner’s Exemptions

Note: all disabled vets must apply for the exemptions. Applications are due March 2. Click here for the application form and more details.

Applications are also available by mail and have been mailed to those who received this exemption last year. State law requires the Assessor’s Office to annually receive a renewal application including the Veterans Administration (VA) certification showing the veteran’s disability level.

Additional Ways to Reduce Your Property Taxes

If you are less than 70% disabled, there is a high possibility that we can further reduce your property taxes if you qualify for additional exemptions and by appealing with both the Cook County Assessor and the Board of Review. Request a free property tax reduction estimate today.

Contact us to learn more about Cook County disabled veteran homeowner exemptions

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees