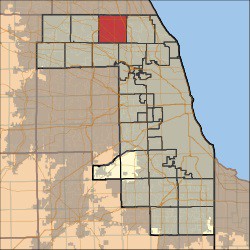

Triennial Reassessment Notices Mailed to Lake Township

The Cook County Assessor’s office mailed triennial reassessment notices on Monday, July 30th to property owners in Lake Township. Lake Township valuation statistics from the Assessor’s office can be found here. Homeowners in Lake Township have one month to appeal their assessment at the Assessor’s office (there is also a second opportunity later in the year at the Board of Review). The deadline for appealing your assessment at the Assessor’s office is August 30th.

The Cook County Assessor’s office mailed triennial reassessment notices on Monday, July 30th to property owners in Lake Township. Lake Township valuation statistics from the Assessor’s office can be found here. Homeowners in Lake Township have one month to appeal their assessment at the Assessor’s office (there is also a second opportunity later in the year at the Board of Review). The deadline for appealing your assessment at the Assessor’s office is August 30th.

We suggest reviewing your assessment annually, especially in a reassessment year, to ensure you do not pay more than your fair share in property taxes. If you think your assessment is not comparable with that of similar homes you should consider appealing (if you would like a free second opinion contact us). Successfully appealing in a reassessment year may provide 3 years of savings on your future property tax bills. The level of success you achieve on your property tax appeal depends on the strength of your appeal argument.

Continue reading

Orland Township 2018 assessment notices were mailed on July 19th by the Cook County Assessor’s office. If your home is in Orland Township you have until the deadline of August 20th to appeal your assessment at the Assessor’s office.

Orland Township 2018 assessment notices were mailed on July 19th by the Cook County Assessor’s office. If your home is in Orland Township you have until the deadline of August 20th to appeal your assessment at the Assessor’s office. Wheeling Township 2018 assessment notices were mailed today by the Cook County Assessor’s office. If your home is in Wheeling Township you have until the deadline of August 17th to appeal your assessment at the Assessor’s office.

Wheeling Township 2018 assessment notices were mailed today by the Cook County Assessor’s office. If your home is in Wheeling Township you have until the deadline of August 17th to appeal your assessment at the Assessor’s office. The Cook County Assessor’s office mailed 2018 assessment notices today to homeowners in Proviso Township. If your home is in Proviso Township you have until the deadline of August 17th to appeal your assessment at the Assessor’s office.

The Cook County Assessor’s office mailed 2018 assessment notices today to homeowners in Proviso Township. If your home is in Proviso Township you have until the deadline of August 17th to appeal your assessment at the Assessor’s office. Your property tax bill is coming and – it will come as no surprise – it’s going to be bigger than it was last year.

Your property tax bill is coming and – it will come as no surprise – it’s going to be bigger than it was last year. Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees