Thornton Township 2019 Assessment Notices Mailed

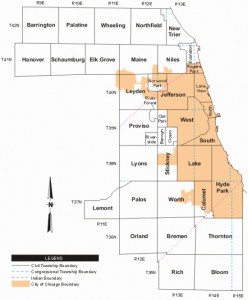

2019 property assessment notices were mailed by the Cook County Assessor’s office on August 27th to Thornton Township property owners. The following cities, towns, and villages are in Thornton Township: Blue Island (southern edge), Burnham, Calumet City, Dixmoor, Dolton, East Hazel Crest, Glenwood (northern 1/4), Harvey, Hazel Crest, Homewood (northeast half), Lansing (northern half), Markham (eastern 1/4), Phoenix, Posen, Riverdale, South Holland, and Thornton. The one month window to appeal your 2019 assessed value is now open until the deadline of September 27th.

We suggest property owners review their assessments annually and appeal whenever there is a strong evidence based argument that your home may not be assessed fairly. Thornton Township’s next triennial reassessment is scheduled for 2020. However, if you feel that your assessment is not fair there is no need to wait to appeal, property owners have the right to appeal every year at the Assessor’s office and at the Board of Review. If you’d like a professional opinion on your home’s assessed value as it compares to similar properties in your neighborhood contact us for a free, no obligation, review and analysis of your home.

Continue reading

The Cook County Board of Review has opened 2019 property tax appeals for the third group. The

The Cook County Board of Review has opened 2019 property tax appeals for the third group. The  There is nothing like the relief you feel when you hand a problem off to an expert. Your mind stops racing and you can turn your attention to other matters with confidence.

There is nothing like the relief you feel when you hand a problem off to an expert. Your mind stops racing and you can turn your attention to other matters with confidence. 2019 Triennial reassessment notices were mailed to Schaumburg Township homeowners on Friday, August 16th. The following cities, towns, and villages are in Schaumburg Township: Elk Grove Village, Hanover Park, Hoffman Estates, Rolling Meadows (south edge), Roselle, Schaumburg, and Streamwood. Homeowners in Schaumburg Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is September 16th.

2019 Triennial reassessment notices were mailed to Schaumburg Township homeowners on Friday, August 16th. The following cities, towns, and villages are in Schaumburg Township: Elk Grove Village, Hanover Park, Hoffman Estates, Rolling Meadows (south edge), Roselle, Schaumburg, and Streamwood. Homeowners in Schaumburg Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is September 16th. The Cook County Board of Review has opened 2019 property tax appeals for the second group of 2 townships. The

The Cook County Board of Review has opened 2019 property tax appeals for the second group of 2 townships. The  2019 property assessment notices were mailed by the Cook County Assessor’s office on August 8th to Orland Township property owners. The following cities, towns, and villages are in Orland Township: Orland Hills, Orland Park, and Tinley Park. The one month window to appeal your 2019 assessed value is now open until the deadline of September 9th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on August 8th to Orland Township property owners. The following cities, towns, and villages are in Orland Township: Orland Hills, Orland Park, and Tinley Park. The one month window to appeal your 2019 assessed value is now open until the deadline of September 9th.  2019 property assessment notices were mailed by the Cook County Assessor’s office on Monday, August 5th, to Jefferson Township property owners. The following cities, towns, and villages are in Jefferson Township: Albany Park, Avondale, Belmont-Cragin, Dunning, Forest Glen, Hermosa, Irving Park, Jefferson Park, Logan Square, Montclare, and Portage Park. The one month window to appeal your 2019 assessed value is now open until the deadline of September 6th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on Monday, August 5th, to Jefferson Township property owners. The following cities, towns, and villages are in Jefferson Township: Albany Park, Avondale, Belmont-Cragin, Dunning, Forest Glen, Hermosa, Irving Park, Jefferson Park, Logan Square, Montclare, and Portage Park. The one month window to appeal your 2019 assessed value is now open until the deadline of September 6th. 2019 Triennial reassessment notices were mailed to Palatine Township homeowners on Friday, August 2nd. The following cities, towns, and villages are in Palatine Township: Arlington Heights (west of Wilke Rd.), Barrington, Deer Park, Hoffman Estates (northeast), Inverness, Palatine, Rolling Meadows (north of Central Road), Schaumburg, and South Barrington. Homeowners in Palatine Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is September 3rd.

2019 Triennial reassessment notices were mailed to Palatine Township homeowners on Friday, August 2nd. The following cities, towns, and villages are in Palatine Township: Arlington Heights (west of Wilke Rd.), Barrington, Deer Park, Hoffman Estates (northeast), Inverness, Palatine, Rolling Meadows (north of Central Road), Schaumburg, and South Barrington. Homeowners in Palatine Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is September 3rd. Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees