The Compound Effect of Property Tax Appeals

In 1716, Christopher Bullock in The Cobbler of Preston wrote, “‘Tis impossible to be sure of any thing but Death and Taxes.”

In 1716, Christopher Bullock in The Cobbler of Preston wrote, “‘Tis impossible to be sure of any thing but Death and Taxes.”

Considering the growing, unfunded pension liabilities of Chicago and the suburbs, you can count on further property tax increases.

The Only Relief

As we’ve said many times before, the only relief you have is to appeal your property taxes. Doing so not only saves you money in the first year, but also may save you money in the years to follow. Not appealing your property taxes almost guarantees your property taxes will go up every year.

Compounding Savings

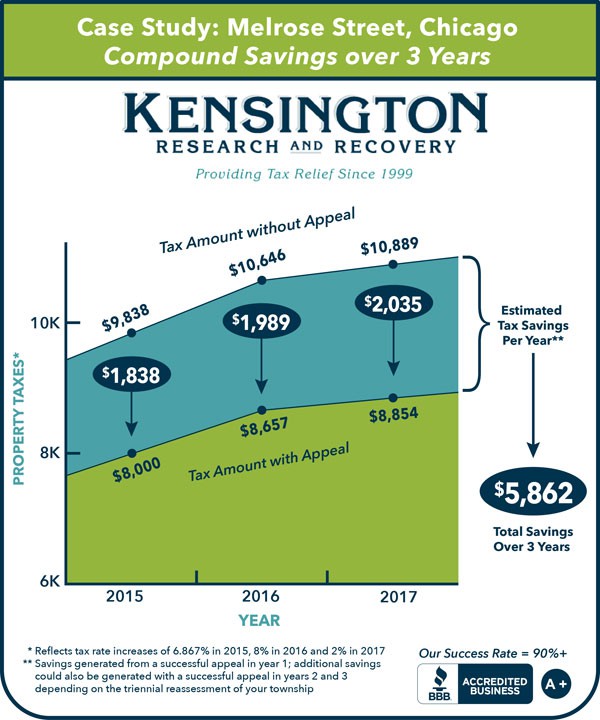

Thus, the difference between what could be saved every year vs. enduring increases every year can have a compounding effect. Consider the following case based on a successful appeal in 2015 on a single family home in Chicago. The original 2015 assessed value according to the Assessor was $55,593. Our successful 2015 appeal reduced the assessed value to $45,684. Using the Chicago Tribune’s property tax increase calculator, which suggests property tax rates will rise due to the increase in pension payments, demonstrates a compounded three year savings of $5,862*.

| Tax Year | Estimated Tax: No Appeal |

Estimated Tax: With Appeal |

Tax Appeal Savings |

| 2015 | $9,838 | $8,000 | $1,838 |

| 2016 | $10,646 | $8,657 | $1,989 |

| 2017 | $10,889 | $8,854 | $2,035 |

| Total Property Tax Appeal Savings | $5,862 | ||

Get your free property tax reduction estimate

* Depending on where township falls in triennial reassessment the savings may last from 1-3 years

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees