Cook County First Installment Tax Bill Coming Due

By now, property owners in Cook County should have received their first installment tax bill in the mail. It’s not a pleasant experience.

By now, property owners in Cook County should have received their first installment tax bill in the mail. It’s not a pleasant experience.

Pension and healthcare shortfalls have put increasing pressure on taxing districts across the county. Chicago residents are in the fourth year of tax hikes as part of the city’s effort to fund police, fire and public school pension obligations.

All that being said, there’s one way to get relief, and you may be able to save hundreds or thousands…

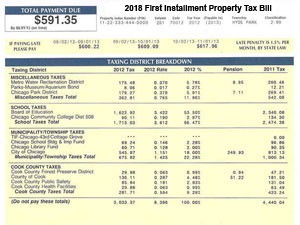

Your First Installment Property Tax Bill

Your first installment does not reflect any change in your assessed value or your exemption status, so if you successfully appealed your assessment last year, you won’t see the results until the second installment goes out in the summer. The first installment is a calculation based on 55% of the previous year’s annual property tax bill.

Your first installment payment is due on the first business day of March, which this year falls on March 1. That’s the bad news. The good news is there are steps you can take to reduce your future property tax bills.

Appeal Now to Reduce Your Future Property Tax Bills

Whatever relief you may see in your second installment bill in several months, now is the time to start thinking about appealing this year’s assessment, whether you filed an appeal last year or not. In order to achieve savings on next year’s property tax bill you need to appeal your assessment this year.

Some homeowners believe appealing their property tax assessment once is enough. That’s a common misconception. However, the best way to make sure you never pay more than your fair share is to appeal your property tax assessment every year. Other than being sure to apply for every exemption for which you are eligible, this is the only way to reduce your property tax bill.

Appealing Your Property Tax Assessment for 2018

Not happy with the size of your current tax bill? Successfully appealing now will help you on your second installment tax bill next year. If you do nothing now, while the appeal window is open, you will likely be in the same situation next year, dreading your tax bill and wishing that you had appealed. The Cook County Assessor’s Office encourages property owners to appeal to be sure that they are not paying more than their fair share. An appeal is the only way to reduce your assessment if it is too high.

We Can Help

If you think you may be paying more than your fair share, contact us for a free review of your property tax situation. If we don’t think you have a strong case for significant savings, we won’t recommend an appeal. But when we do assist with an appeal, you’ll have the benefit of our proprietary algorithm for finding the right comparable properties using a vast database of valuations, prior appeals and property characteristics. You’ll also have the advantage that comes from our track record of success.

We have successfully assisted on more than 24,000 residential tax assessment appeals in Cook County. We can help you with your appeal at the assessor and again at the Board of Review to ensure the maximum savings. We have a success rate of more than 90%. Contact us today to find out if you may be our next success story.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees