Reassessment Notices Mailed for Rich Township

Rich Township reassessment notices were mailed by the Assessor’s office on Friday, September 1st. The one month window to appeal your assessment at the Assessor’s Office is open until Monday, October 2nd.

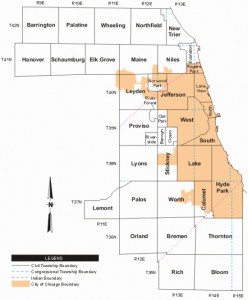

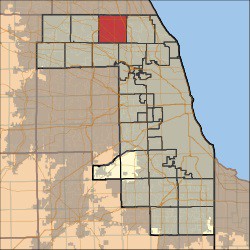

Rich Township is in the south group of townships which is being reassessed in 2017 by the Assessor’s office. You can locate complete valuation statistics for Rich Township on the Assessor’s site here.

Contact us before the October 2nd deadline for a free analysis and professional opinion on your reassessment valuation in comparison to others and your appeal options. Appealing in a reassessment year may allow you to achieve savings for multiple years on your future property tax bills, until your next triennial reassessment.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees