Calumet Township 2019 Assessment Notices Mailed

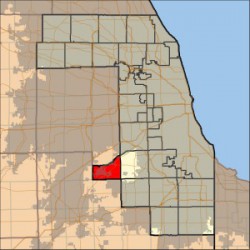

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 14th to Calumet Township property owners. The following cities, towns, and villages are in Calumet Township: Blue Island (east half), Calumet Park, and Riverdale. The one month window to appeal your 2019 assessed value is now open until the deadline of July 15th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 14th to Calumet Township property owners. The following cities, towns, and villages are in Calumet Township: Blue Island (east half), Calumet Park, and Riverdale. The one month window to appeal your 2019 assessed value is now open until the deadline of July 15th.

We suggest property owners review their assessments annually and appeal whenever there is a strong evidence based argument that your home may not be assessed fairly. Calumet Township’s next triennial reassessment is scheduled for 2020. However, if you feel that your assessment is not fair there is no need to wait to appeal, property owners have the right to appeal every year at the Assessor’s office and at the Board of Review. If you’d like a professional opinion on your home’s assessed value as it compares to similar properties in your neighborhood contact us for a free, no obligation, review and analysis of your home.

Continue reading

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 12th to Lemont Township property owners. The following cities, towns, and villages are in Lemont Township: Lemont, Palos Park (west edge), Willow Springs, and Woodridge. The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 15th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 12th to Lemont Township property owners. The following cities, towns, and villages are in Lemont Township: Lemont, Palos Park (west edge), Willow Springs, and Woodridge. The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 15th. 2019 property assessment notices were mailed by the Cook County Assessor’s office on June 4th to Bremen Township property owners. The following cities, towns, and villages are in Bremen Township: Oak Forest, Midlothian, Posen, Robbins, Blue Island (portion), Homewood (portion), Orland Park (portion), Tinley Park (portion), Crestwood (portion), Hazel Crest (portion), Markham (portion), Country Club Hills (portion), and Harvey (the very Western edge). The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 5th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 4th to Bremen Township property owners. The following cities, towns, and villages are in Bremen Township: Oak Forest, Midlothian, Posen, Robbins, Blue Island (portion), Homewood (portion), Orland Park (portion), Tinley Park (portion), Crestwood (portion), Hazel Crest (portion), Markham (portion), Country Club Hills (portion), and Harvey (the very Western edge). The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 5th. 2019 Triennial reassessment notices were mailed to Barrington Township homeowners on June 4th. The following cities, towns, and villages are in Barrington Township: Barrington, Barrington Hills (south ¾), East Dundee, Hoffman Estates, Inverness (west ¼), and South Barrington. Homeowners in Barrington Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is July 5th.

2019 Triennial reassessment notices were mailed to Barrington Township homeowners on June 4th. The following cities, towns, and villages are in Barrington Township: Barrington, Barrington Hills (south ¾), East Dundee, Hoffman Estates, Inverness (west ¼), and South Barrington. Homeowners in Barrington Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is July 5th. 2019 property assessment notices were mailed by the Cook County Assessor’s office today to Stickney Township property owners. The following cities, towns, and villages are in Stickney Township: Bedford Park (east ¾), Bridgeview, Burbank, Forest View (majority), and Stickney. The 30 day window to appeal your 2019 assessed value is now open until the deadline of June 28th.

2019 property assessment notices were mailed by the Cook County Assessor’s office today to Stickney Township property owners. The following cities, towns, and villages are in Stickney Township: Bedford Park (east ¾), Bridgeview, Burbank, Forest View (majority), and Stickney. The 30 day window to appeal your 2019 assessed value is now open until the deadline of June 28th. Triennial reassessment notices were mailed to Northfield Township homeowners on May 24th. The following cities, towns, and villages are in Northfield Township: Glencoe, Glenview, Northbrook (majority), Northfield (west ¾), Prospect Heights (east edge), Wilmette (west edge), and Des Plaines (north edge). Homeowners in Northfield Township have one month to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is June 24th.

Triennial reassessment notices were mailed to Northfield Township homeowners on May 24th. The following cities, towns, and villages are in Northfield Township: Glencoe, Glenview, Northbrook (majority), Northfield (west ¾), Prospect Heights (east edge), Wilmette (west edge), and Des Plaines (north edge). Homeowners in Northfield Township have one month to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is June 24th. The Cook County Assessor’s office mailed 2019 property assessment notices to Lyons Township property owners on Monday, May 20th. The following cities, towns, and villages are in Lyons Township: Bedford Park, Bridgeview, Brookfield, Burr Ridge, Countryside, Hickory Hills, Hinsdale, Hodgkins, Indian Head Park, Justice, La Grange, La Grange Highlands, Lyons, McCook, Pleasantdale, Ridgewood, Riverside, Summit, Western Springs, and Willow Springs. The one month window to appeal your 2019 assessed value is now open until the deadline of June 21st.

The Cook County Assessor’s office mailed 2019 property assessment notices to Lyons Township property owners on Monday, May 20th. The following cities, towns, and villages are in Lyons Township: Bedford Park, Bridgeview, Brookfield, Burr Ridge, Countryside, Hickory Hills, Hinsdale, Hodgkins, Indian Head Park, Justice, La Grange, La Grange Highlands, Lyons, McCook, Pleasantdale, Ridgewood, Riverside, Summit, Western Springs, and Willow Springs. The one month window to appeal your 2019 assessed value is now open until the deadline of June 21st. Cook County’s tax assessor’s office is under new leadership, with the swearing in earlier this month of Fritz Kaegi, a former asset manager who has promised a new era of accountability for the office.

Cook County’s tax assessor’s office is under new leadership, with the swearing in earlier this month of Fritz Kaegi, a former asset manager who has promised a new era of accountability for the office. The Cook County Board of Review has opened the final group of townships for 2018 property tax appeals. If your home is located in one of the 4 townships listed below the

The Cook County Board of Review has opened the final group of townships for 2018 property tax appeals. If your home is located in one of the 4 townships listed below the  The Cook County Board of Review has opened the sixth group of townships for 2018 property tax appeals. If your property is located in one of the 7 townships listed below the

The Cook County Board of Review has opened the sixth group of townships for 2018 property tax appeals. If your property is located in one of the 7 townships listed below the  Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees