Board of Review Opens Group 5 for 2020 Appeals

The Cook County Board of Review has opened 2020 property tax appeals for the fifth group of townships. The Board’s deadline to appeal your 2020 assessed value is November 24th. Below are the townships that are currently open in Group 5:

The Cook County Board of Review has opened 2020 property tax appeals for the fifth group of townships. The Board’s deadline to appeal your 2020 assessed value is November 24th. Below are the townships that are currently open in Group 5:

- Berwyn

- Stickney

- Worth

- West Chicago

- Lemont

If you missed your appeal opportunity at the Assessor’s office earlier in the year, or if you did appeal and weren’t satisfied with the result, you have a second opportunity to appeal at the Board of Review. Appealing your home’s 2020 assessed value is the only way to achieve property tax relief on your second installment property tax bill in July 2021, other than selling your home or claiming a new exemption. Assessments can be appealed every year, regardless of when a township was reassessed.

Continue reading

2020 Triennial reassessment notices were mailed to Lemont Township homeowners on Wednesday, May 27th. Homeowners in Lemont Township have 36 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is July 2nd.

2020 Triennial reassessment notices were mailed to Lemont Township homeowners on Wednesday, May 27th. Homeowners in Lemont Township have 36 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is July 2nd.

The Cook County Board of Review has opened 2019 property tax appeals for the sixth group. The

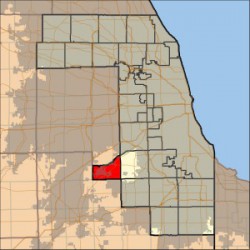

The Cook County Board of Review has opened 2019 property tax appeals for the sixth group. The  2019 property assessment notices were mailed by the Cook County Assessor’s office on June 12th to Lemont Township property owners. The following cities, towns, and villages are in Lemont Township: Lemont, Palos Park (west edge), Willow Springs, and Woodridge. The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 15th.

2019 property assessment notices were mailed by the Cook County Assessor’s office on June 12th to Lemont Township property owners. The following cities, towns, and villages are in Lemont Township: Lemont, Palos Park (west edge), Willow Springs, and Woodridge. The 30 day window to appeal your 2019 assessed value is now open until the deadline of July 15th. The 3rd group of townships has opened at the Cook County Board of Review for 2018 property tax appeals. If your property is located in one of the 6 townships listed below the

The 3rd group of townships has opened at the Cook County Board of Review for 2018 property tax appeals. If your property is located in one of the 6 townships listed below the  Assessment notices were mailed today by the Cook County Assessor’s office to homeowners in the townships of Barrington and Lemont. If your home is in either of these townships you have until July 5th to review and appeal your assessment at the Assessor’s office. There will be a second appeal opportunity later this year at the Board of Review.

Assessment notices were mailed today by the Cook County Assessor’s office to homeowners in the townships of Barrington and Lemont. If your home is in either of these townships you have until July 5th to review and appeal your assessment at the Assessor’s office. There will be a second appeal opportunity later this year at the Board of Review.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees