Reassessment Notices Mailed For Orland Township

The Cook County Assessor’s Office has mailed reassessment notices to all properties in Orland Township. The one month window to appeal your assessed value at the Assessor’s Office is now open with a deadline of August 28th.

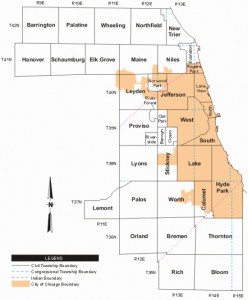

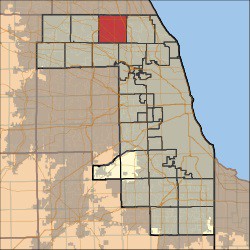

Orland Township is part of the south group which is being reassessed this year. Complete valuation statistics for Orland are published by the Assessor’s Office and located here.

Contact us for a free analysis of your property’s assessment and our professional opinion on your appeal options. Appealing your property’s assessed value in a reassessment year may allow you to secure savings for multiple years, until your next triennial reassessment.

When you see or hear the words “Cook County property taxes” in the headlines, you can pretty much assume it’s not going to be good news. Unless, perhaps, you are a well-heeled business owner with a team of attorneys scrutinizing your tax bills.

When you see or hear the words “Cook County property taxes” in the headlines, you can pretty much assume it’s not going to be good news. Unless, perhaps, you are a well-heeled business owner with a team of attorneys scrutinizing your tax bills.

“Chicago Homeowners are about to get whacked with a 10% increase in their property taxes,” reports Greg Hinz in his Crain’s article,

“Chicago Homeowners are about to get whacked with a 10% increase in their property taxes,” reports Greg Hinz in his Crain’s article,

Jason Grotto’s recent expose in the Chicago Tribune is entitled,

Jason Grotto’s recent expose in the Chicago Tribune is entitled,  Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees