Hanover Township Assessment Notices Mailed

Hanover Township 2017 assessment notices were mailed by the Assessor’s office on September 5th. The one month appeal window is open through the October 5th deadline.

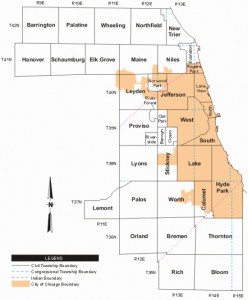

Hanover Township is in the north suburbs district which was reassessed in 2016. The next triennial reassessment for Hanover Township will be in 2019. Successful appeals in 2017 may result in savings for two years, until Hanover’s next reassessment in 2019.

For a free professional opinion on your property’s assessment level in comparison to others reach out to us before the deadline of October 5th.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees