Continued Push for Bill to Require Commercial Income Data

Cook County Assessor Fritz Kaegi has not given up on efforts to pass legislation requiring some commercial property owners to submit information about building income to the assessor’s office, which he has called “the first, best step in legislative tax reform.”

Cook County Assessor Fritz Kaegi has not given up on efforts to pass legislation requiring some commercial property owners to submit information about building income to the assessor’s office, which he has called “the first, best step in legislative tax reform.”

The so-called Data Modernization Bill passed the Illinois Senate earlier this year, but was shelved by a House committee amid opposition from groups that include the Building Owners and Managers Association of Chicago, the Illinois Retail Merchants Association and the Chicagoland Chamber of Commerce, among others. Opponents say the bill would impose burdensome reporting requirements and includes information that is confidential.

There is nothing like the relief you feel when you hand a problem off to an expert. Your mind stops racing and you can turn your attention to other matters with confidence.

There is nothing like the relief you feel when you hand a problem off to an expert. Your mind stops racing and you can turn your attention to other matters with confidence.

2019 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, July 11th, to Hyde Park Township property owners. The following cities, towns, and villages are in Hyde Park Township: Avalon Park, Burnside, Calumet Heights, Chatham (portion), East Side, Grand Boulevard (portion), Greater Grand Crossing (portion), Hegewisch, Hyde Park, Kenwood, Oakland (portion), Pullman, Riverdale, Roseland (portion), South Chicago, South Deering, South Shore, Washington Park (portion), West Pullman (portion), and Woodlawn. The one month window to appeal your 2019 assessed value is now open until the deadline of August 12th.

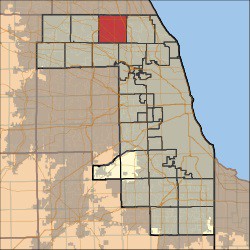

2019 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, July 11th, to Hyde Park Township property owners. The following cities, towns, and villages are in Hyde Park Township: Avalon Park, Burnside, Calumet Heights, Chatham (portion), East Side, Grand Boulevard (portion), Greater Grand Crossing (portion), Hegewisch, Hyde Park, Kenwood, Oakland (portion), Pullman, Riverdale, Roseland (portion), South Chicago, South Deering, South Shore, Washington Park (portion), West Pullman (portion), and Woodlawn. The one month window to appeal your 2019 assessed value is now open until the deadline of August 12th. 2019 Triennial reassessment notices were mailed to Wheeling Township homeowners on Monday, July 8th. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Glenview, Mount Prospect, Northbrook, Palatine (east of 53), Prospect Heights (majority), Rolling Meadows, and Wheeling (majority). Homeowners in Wheeling Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is August 8th.

2019 Triennial reassessment notices were mailed to Wheeling Township homeowners on Monday, July 8th. The following cities, towns, and villages are in Wheeling Township: Arlington Heights, Buffalo Grove, Des Plaines, Glenview, Mount Prospect, Northbrook, Palatine (east of 53), Prospect Heights (majority), Rolling Meadows, and Wheeling (majority). Homeowners in Wheeling Township have 30 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is August 8th. Just when you thought it was safe to venture outside again, there is that envelope from the Cook County treasurer.

Just when you thought it was safe to venture outside again, there is that envelope from the Cook County treasurer. A bill awaiting the governor’s signature will make it easier for property owners age 65 or older to get the senior tax exemption credit, which reduces the equalized assessed value of a home by $8,000.

A bill awaiting the governor’s signature will make it easier for property owners age 65 or older to get the senior tax exemption credit, which reduces the equalized assessed value of a home by $8,000. The Cook County Board of Review has opened 2019 property tax appeals for the first group of 7 townships. The

The Cook County Board of Review has opened 2019 property tax appeals for the first group of 7 townships. The  Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees