Chicago Property Taxes Going Up, But By a Little Less

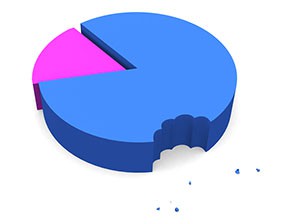

Your property tax bill is coming and – it will come as no surprise – it’s going to be bigger than it was last year.

Your property tax bill is coming and – it will come as no surprise – it’s going to be bigger than it was last year.

But here’s what passes for the good news: In Chicago, property taxes are going up by less than they did last year.

The rates, released by the Cook County Clerk’s Office, show that the average property tax bill for homeowners in the city will be about 2.75% higher than last year, or about an extra $110 for the owner of an average single-family residence with a market value of $224,500.

Last year’s tax hike cost that same homeowner an additional $363 – an increase of 10 percent.

The Cook County Assessor’s office mailed 2018 assessment notices today to homeowners in Leyden Township. If your home is in Leyden Township you have until the deadline of July 30th to appeal your assessment at the Assessor’s office.

The Cook County Assessor’s office mailed 2018 assessment notices today to homeowners in Leyden Township. If your home is in Leyden Township you have until the deadline of July 30th to appeal your assessment at the Assessor’s office. If you are a Chicago-area homeowner and it feels like property taxes are eating you alive, it is not entirely your imagination. Nine Chicago-area cities made a list of places across the country where property taxes take the biggest bite relative to median housing costs, according to a recently published analysis.

If you are a Chicago-area homeowner and it feels like property taxes are eating you alive, it is not entirely your imagination. Nine Chicago-area cities made a list of places across the country where property taxes take the biggest bite relative to median housing costs, according to a recently published analysis. 2018 assessment notices were mailed today by the Cook County Assessor’s office to property owners in Worth Township, IL. If your home is in Worth Township you have approximately one month to appeal your assessed value at the Assessor’s office, up to the deadline of July 23rd.

2018 assessment notices were mailed today by the Cook County Assessor’s office to property owners in Worth Township, IL. If your home is in Worth Township you have approximately one month to appeal your assessed value at the Assessor’s office, up to the deadline of July 23rd. Hyde Park triennial reassessment notices were mailed on Tuesday, June 19th by the Cook County Assessor’s office. Hyde Park valuation statistics from the Assessor’s office can be found

Hyde Park triennial reassessment notices were mailed on Tuesday, June 19th by the Cook County Assessor’s office. Hyde Park valuation statistics from the Assessor’s office can be found  Assessment notices were mailed today by the Cook County Assessor’s office to homeowners in the townships of Barrington and Lemont. If your home is in either of these townships you have until July 5th to review and appeal your assessment at the Assessor’s office. There will be a second appeal opportunity later this year at the Board of Review.

Assessment notices were mailed today by the Cook County Assessor’s office to homeowners in the townships of Barrington and Lemont. If your home is in either of these townships you have until July 5th to review and appeal your assessment at the Assessor’s office. There will be a second appeal opportunity later this year at the Board of Review. In a year in which the Cook County property tax system was repeatedly declared broken – by investigative journalists, a non-profit group, an academic study and, indirectly, the voters who decided in March not to return Cook County Assessor Joseph Berrios to office – the

In a year in which the Cook County property tax system was repeatedly declared broken – by investigative journalists, a non-profit group, an academic study and, indirectly, the voters who decided in March not to return Cook County Assessor Joseph Berrios to office – the  2018 assessment notices were mailed today by the Cook County Assessor’s office to homeowners in Calumet Township. If your home is in Calumet Township you have approximately one month to appeal your assessed value at the Assessor’s office, up to the deadline of July 2nd.

2018 assessment notices were mailed today by the Cook County Assessor’s office to homeowners in Calumet Township. If your home is in Calumet Township you have approximately one month to appeal your assessed value at the Assessor’s office, up to the deadline of July 2nd. Stickney Township 2018 assessment notices were mailed to homeowners by the Cook County Assessor’s office today. If your property is in Stickney Township you have 30 days to appeal your assessed value at the Assessor’s office, up to the deadline of June 22nd.

Stickney Township 2018 assessment notices were mailed to homeowners by the Cook County Assessor’s office today. If your property is in Stickney Township you have 30 days to appeal your assessed value at the Assessor’s office, up to the deadline of June 22nd. Assessment notices for tax year 2018 have been mailed to property owners in Northfield Township. If your home is in Northfield Township you have one month to appeal your assessed value at the Assessor’s office until the deadline of June 21st.

Assessment notices for tax year 2018 have been mailed to property owners in Northfield Township. If your home is in Northfield Township you have one month to appeal your assessed value at the Assessor’s office until the deadline of June 21st. Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees