Why Do So Many Cook County Homeowners Fail to Appeal Even When the Assessor Recommends It?

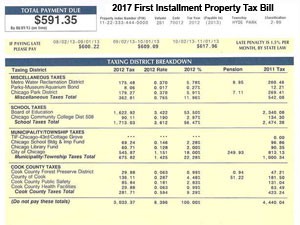

Every three years, Cook County homeowners get re-assessed. Since the Great Recession is over, property taxes are dramatically increasing to pay for unfunded pensions and the Chicago Public Schools shortfall.

Every three years, Cook County homeowners get re-assessed. Since the Great Recession is over, property taxes are dramatically increasing to pay for unfunded pensions and the Chicago Public Schools shortfall.

Did you know that your last assessment was a “rough draft” and that, if you didn’t appeal, you will probably pay a lot more than your fair share because you didn’t do what Cook County requires you to do to ensure a fair assessment?

This comes straight from the Cook County Assessor’s Office.

The “Rough Draft” of Your Home’s Re-Assessment

According to Tom Shaer of the Cook County Assessor’s Office, as reported in the recent Crain’s article by Dennis Rodkin, “The first reassessment homeowners get is essentially a rough draft, meant to be tailored via an appeal. The appeal process is part of turning macro-data that comes from a computerized system into sophisticated micro-data that reflects the individual nature of each property.”

Don’t Believe It?

Perhaps because we assist with appealing Cook County homeowners’ property tax assessments, you may think we are making too big a deal out of this. If so, how about this from Fran Sitkiewicz, the Riverside Township Assessor: “The assessment feels like something you have control over. So you appeal it. Homeowners don’t want to get caught paying any more in taxes than they have to.”

What happens if you don’t appeal? A flawed assessment of your home may stay in place and you may pay more – possibly hundreds or thousands more – if you don’t appeal.

We think you should pay property taxes – just not more than your fair share and an appeal is the only way to ensure fairness, which is what the Cook County Assessor’s Office has been saying for years.

The Kensington Numbers: Only a Tiny Fraction of Homeowners Appeal

According to what is reported in Mr. Rodkin’s article and our comprehensive Cook County homeowner data that we’ve acquired and honed for many years, we’ve learned the following:

- Emilio Cundari from Cicero Township says 850 homeowners went to his office to appeal. We’ve conducted an analysis with our algorithm on all single family homes in Cicero Township (14,497) and estimate that 5,999 of them are significantly over assessed. Though some will appeal online or use a third-party service like Kensington, many more simply live with being over-assessed.

- Robert Maloney from Palos Township says they handled 1,200 appeals in their office. There are 20,435 single family homes in Palos Township of which we estimate 6,154 are significantly over assessed.

- Since the Assessor’s office has stated that their reassessment process is merely a “rough draft” there does not appear, in our professional opinion, to be nearly enough appeals being filed to correct/reflect the “individual nature of each property.”

Have You Heard from Kensington Yet?

We pre-qualify everyone we contact about a possible property tax appeal so, if you’ve heard from us, it is our professional opinion that your property’s valuation falls in that group of homes that we feel is over assessed and whose valuation should be “tailored via an appeal.”

If you haven’t heard from us, we can conduct a free, no-obligation property tax reduction estimate. We only suggest appealing based on what we estimate from our proprietary algorithm, and only if it’s a significant savings.

Appealing is the only way you can save hundreds or thousands in the future and to ensure the “final draft” of your property assessment has you paying the right amount.

Get Your Free Property Tax Reduction Estimate

Every three years, Cook County homeowners get re-assessed. Since the Great Recession is over,

Every three years, Cook County homeowners get re-assessed. Since the Great Recession is over,

Up until April 29, 2017,

Up until April 29, 2017,  As we all await the dreaded second installment of our 2017 property tax bills, two concerns arise for what we’ll find in our mailbox:

As we all await the dreaded second installment of our 2017 property tax bills, two concerns arise for what we’ll find in our mailbox:

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees