Cook County Assessor Extends Deadline for 9 Townships

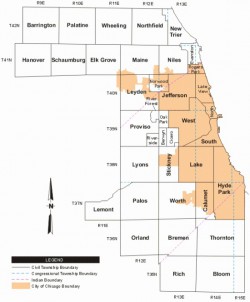

The Cook County Assessor’s Office has extended the deadline for 2020 property tax appeals for nine Townships. The Assessor’s deadline to appeal your 2020 assessed value is now May 1st for the following townships:

The Cook County Assessor’s Office has extended the deadline for 2020 property tax appeals for nine Townships. The Assessor’s deadline to appeal your 2020 assessed value is now May 1st for the following townships:

- Evanston

- Norwood Park

- Rogers Park

- New Trier

- Barrington

- River Forest

- Riverside

- Oak Park

- Palos

We recommend property owners review their assessments annually and appeal whenever there is a strong evidence based argument that your home may not be assessed fairly. Barrington, New Trier, Norwood Park, and Evanston Townships were reassessed in 2019 but even if you appealed last year you may appeal your assessment again this year. A successful appeal in 2020 may result in two years of savings, until Barrington, New Trier, Norwood Park, and Evanston are reassessed in 2022. Rogers Park Township’s next triennial reassessment is scheduled for 2021. River Forest, Riverside, Oak Park, and Palos triennial reassessments occurred between February and March of this year. Any savings received in 2020 for River Forest, Riverside, Oak Park, and Palos will last for 3 years, until the next triennial reassessment in 2023. The best way to ensure you never pay more than your fair share in property taxes is to review your assessment every year and appeal whenever you have a strong basis for an appeal argument, no matter where your township is at in the triennial reassessment cycle.

Continue reading →

The Cook County Board of Review has opened 2020 property tax appeals for Norwood Park. The Board’s deadline to appeal your 2020 assessed value is October 27th.

The Cook County Board of Review has opened 2020 property tax appeals for Norwood Park. The Board’s deadline to appeal your 2020 assessed value is October 27th.

The Cook County Assessor’s Office has extended the deadline for 2020 property tax appeals for nine Townships. The

The Cook County Assessor’s Office has extended the deadline for 2020 property tax appeals for nine Townships. The  With health and safety as the primary concern at the moment, the Cook County Assessor’s Office has

With health and safety as the primary concern at the moment, the Cook County Assessor’s Office has

Triennial reassessment notices were mailed to Norwood Park Township property owners on Friday, February 22nd. Norwood Park valuation statistics from the Cook County Assessor’s office can be found

Triennial reassessment notices were mailed to Norwood Park Township property owners on Friday, February 22nd. Norwood Park valuation statistics from the Cook County Assessor’s office can be found  2020 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, February 20th, to Norwood Park Township property owners. The window to appeal your 2020 assessed value is now open until the deadline of May 1st.

2020 property assessment notices were mailed by the Cook County Assessor’s office on Thursday, February 20th, to Norwood Park Township property owners. The window to appeal your 2020 assessed value is now open until the deadline of May 1st. The Cook County Board of Review has opened 2019 property tax appeals for the first group of 7 townships. The

The Cook County Board of Review has opened 2019 property tax appeals for the first group of 7 townships. The

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees