Senior Exemption Deadlines Approaching

Senior citizens who are newly eligible for a senior citizen property tax exemption or who are eligible for the income-based Senior Freeze Exemption, have until April 10th to apply, under a recently extended deadline.

Under a new law passed last year, senior citizens who have already qualified for the standard senior citizen exemption in past years do not have to reapply. The exemption is now automatically renewed.

Applicants for the Senior Freeze Exemption however, are required to apply each year. Cook County homeowners age 65 or older who have household incomes of $65,000 or less may qualify. This senior freeze exemption provides additional property tax deductions to offset increases in assessed property values.

Continue reading

Every year, the Cook County Assessor accepts property tax appeals for each

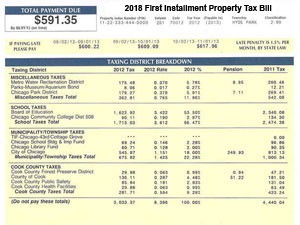

Every year, the Cook County Assessor accepts property tax appeals for each  By now, property owners in Cook County should have received their first installment tax bill in the mail. It’s not a pleasant experience.

By now, property owners in Cook County should have received their first installment tax bill in the mail. It’s not a pleasant experience. The Cook County Assessor’s office mailed 2019 assessment notices to Rogers Park property owners on Friday, February 15th. The 30 day window to appeal your assessed value at the Assessor’s office is now open until the deadline of March 18th.

The Cook County Assessor’s office mailed 2019 assessment notices to Rogers Park property owners on Friday, February 15th. The 30 day window to appeal your assessed value at the Assessor’s office is now open until the deadline of March 18th. If you’re like many Cook County homeowners, you probably cringe when you open your property tax bill to discover yet another hike.

If you’re like many Cook County homeowners, you probably cringe when you open your property tax bill to discover yet another hike. The

The  Veterans who own a home in Cook County that are disabled 70% or more no longer have to pay property taxes thanks to recent legislation (SB 107).

Veterans who own a home in Cook County that are disabled 70% or more no longer have to pay property taxes thanks to recent legislation (SB 107). Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees